The escalating situation in the Red Sea has forced Tesla to halt production at its gigafactory in Germany, in what marks the latest headache for Elon Musk’s car company in Europe.

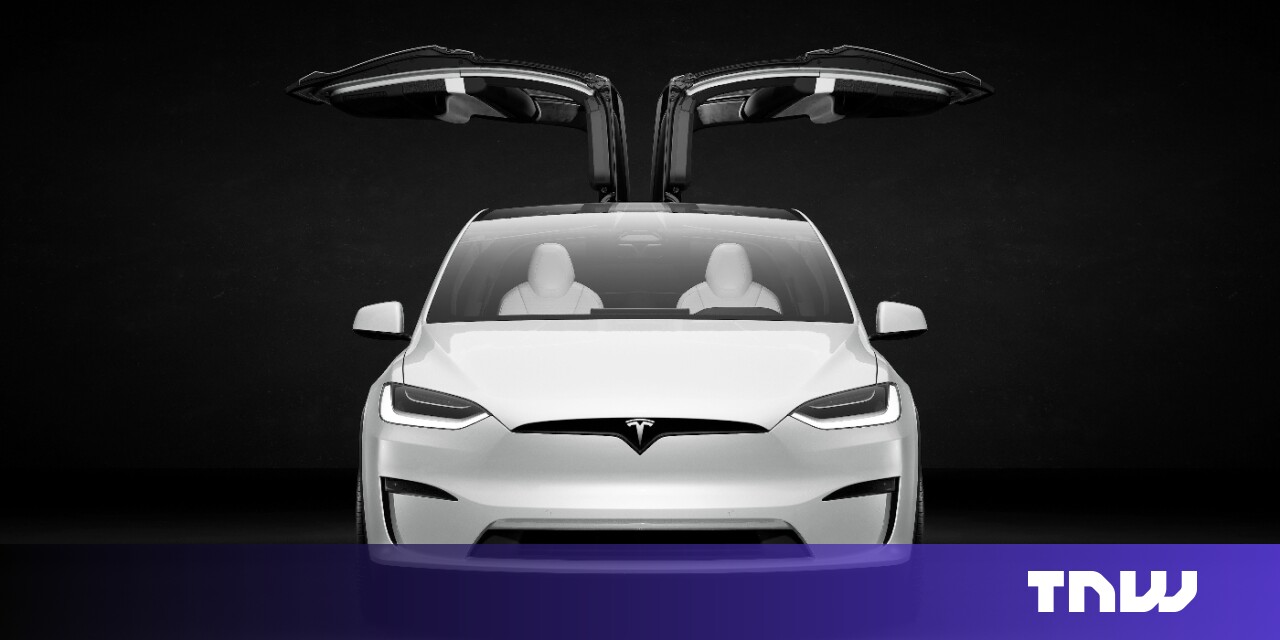

The carmaker said last week that production at its plant in Berlin, which makes Model Y vehicles and batteries, will be put on hold from January 29 to February 11 due to a “lack of parts.”

Tesla heavily relies on components from China to produce its EVs. Many of these get shipped through the Suez Canal, the fastest route between Asia and Europe. However, increasing attacks against cargo ships by Yemen-based Houthi Rebels in the region have forced many of these vessels to reroute round the southern tip of Africa, causing weeks-long delays.

The Berlin-Brandenburg Gigafactory is where Tesla assembles electric vehicles it sells in Europe. The company did not specify which components affecting the factory’s operations have been delayed.

This supply chain disruption is the latest blow for Tesla’s European operations. Over the last few months, the company has been battling the worst strikes in its history in Sweden, intense competition from rivals, and plummeting European sales.

Tesla fights fires

Tesla has lost more than $94bn in market valuation in just the first two weeks of 2024. The EV maker has been pounded by a barrage of negative news, including car rental giant Hertz offloading its fleet of the American EVs, yet another price cut is coming for Teslas made in China, and signs of rising labour costs. And then there’s the Swedish union action.

Workers at Tesla repair shops in Sweden downed tools on October 27, seeking collective agreements to provide better wages and benefits for mechanics. The strike has since spread to Norway, Finland, and Denmark in what is the biggest union action the company has ever faced.

The uprising is a direct consequence of Musk’s refusal to accept unionisation of Tesla workers — a policy that also risks disrupting operations in the US and Germany where it has the majority of its employees.

This comes amid a difficult fourth quarter last year which saw Warren Buffet-backed Chinese rival BYD knocking Tesla from the top spot as the world’s best selling EV manufacturer. This was thanks to aggressive price cutting by the Chinese company but is also a sign that Tesla’s preoccupation with Musk’s very expensive pet projects, such as the long-awaited cybertruck, might be taking its toll.

At the same time, sales of Tesla cars in Germany, home to its only European manufacturing plant, plunged a shocking 77% in December year-on-year. While Tesla is still a force to be reckoned with, especially in Norway, Musk’s haphazard antics could be giving rivals an opportunity to pounce. Watch this space.