VentureBeat presents: AI Unleashed – An exclusive executive event for enterprise data leaders. Network and learn with industry peers. Learn More

Cowbell, the four-year-old company formerly known as “Cowbell Cyber” that offers cyber threat monitoring and insurance that helps cover its customers’ costs in the event of a breach or ransomware payment, has enjoyed a blockbuster year, reporting 49% growth year-over-year so far — and it’s not slowing down anytime soon.

Today the Pleasanton, California-headquartered company announced it has raised another round of $25 million from Prosperity7 Ventures, the diversified growth fund of Aramco Ventures, itself a subsidiary of Saudi Arabian oil giant Aramco. That’s notable since Aramco itself has been the target and victim of major cyber attacks, including the largest in history.

If the VC fund of one of the largest and most enticing targets of cyber attackers believes in Cowbell’s technology, the company must be doing something right.

“The platform monitors 38 million small and medium-sized enterprises (SMEs) processes 15 TB of normalized data, and 12B+ cumulative signals,” wrote Jack Kudale, Cowbell co-founder and CEO, in a response to VentureBeat’s questions emailed by a spokesperson.

Event

AI Unleashed

An exclusive invite-only evening of insights and networking, designed for senior enterprise executives overseeing data stacks and strategies.

What Cowbell offers

Cowbell offers several products designed to fit the evolving needs of its customer enterprises and the size of their operations, from small and medium-sized businesses (SMBs) to large enterprises and multinational conglomerates.

At a high level, Cowbell’s adaptive cyber insurance aligns cyber insurance coverage and pricing with an organization’s evolving cyber risk profile through continuous, automated risk assessment, incentives for risk reduction and closed-loop risk management.

Its adaptive cyber insurance is available in three broad flavors:

- Cowbell Prime 100 is designed to cover companies that makeup to $100 million USD in annual revenue

- Cowbell Prime 250 offers coverage for enterprises with annual revenue up to $500 million USD as well as “risk engineering consultation and complimentary cybersecurity awareness training with their policies.”

- Cowbell Prime Plus goes even higher, for those multinationals that require even more coverage. It also comes with everything the first two plans offer.

The way Cowbell monitors its customers for cyber intrusions and tests their networks’ readiness is through artificial intelligence (AI) and machine learning (ML) algorithms, which examine more than 1000 qualities about the customer’s networks and software.

In April, the company debuted MooGPT, its first GPT-powered generative AI conversational assistant for providing customers with quick answers to their questions about their Cowbell cyber insurance policies and risk assessments.

“New generative AI models are now assisting with submission intake, underwriting co-pilot, and MooGPT for customer service,” Kudale wrote to VentureBeat. “The real-time global threat landscape integration monitors zero-day vulnerabilities to provide early warning signals to policyholders, resulting in an average claims severity of $140K and an average claims frequency of < 3%. The platform has further added transparency into the cyber risk marketplace among brokers, policyholders, reinsurers, and claims panels, as they all work from the same data set.”

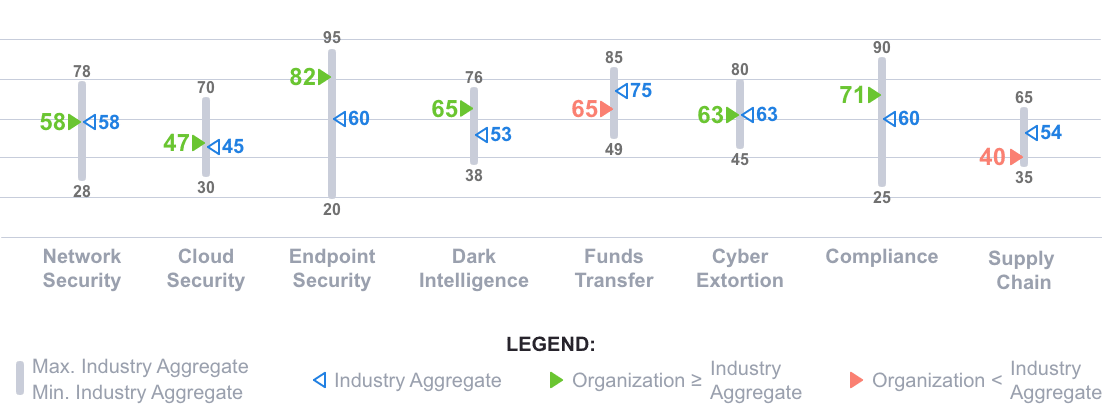

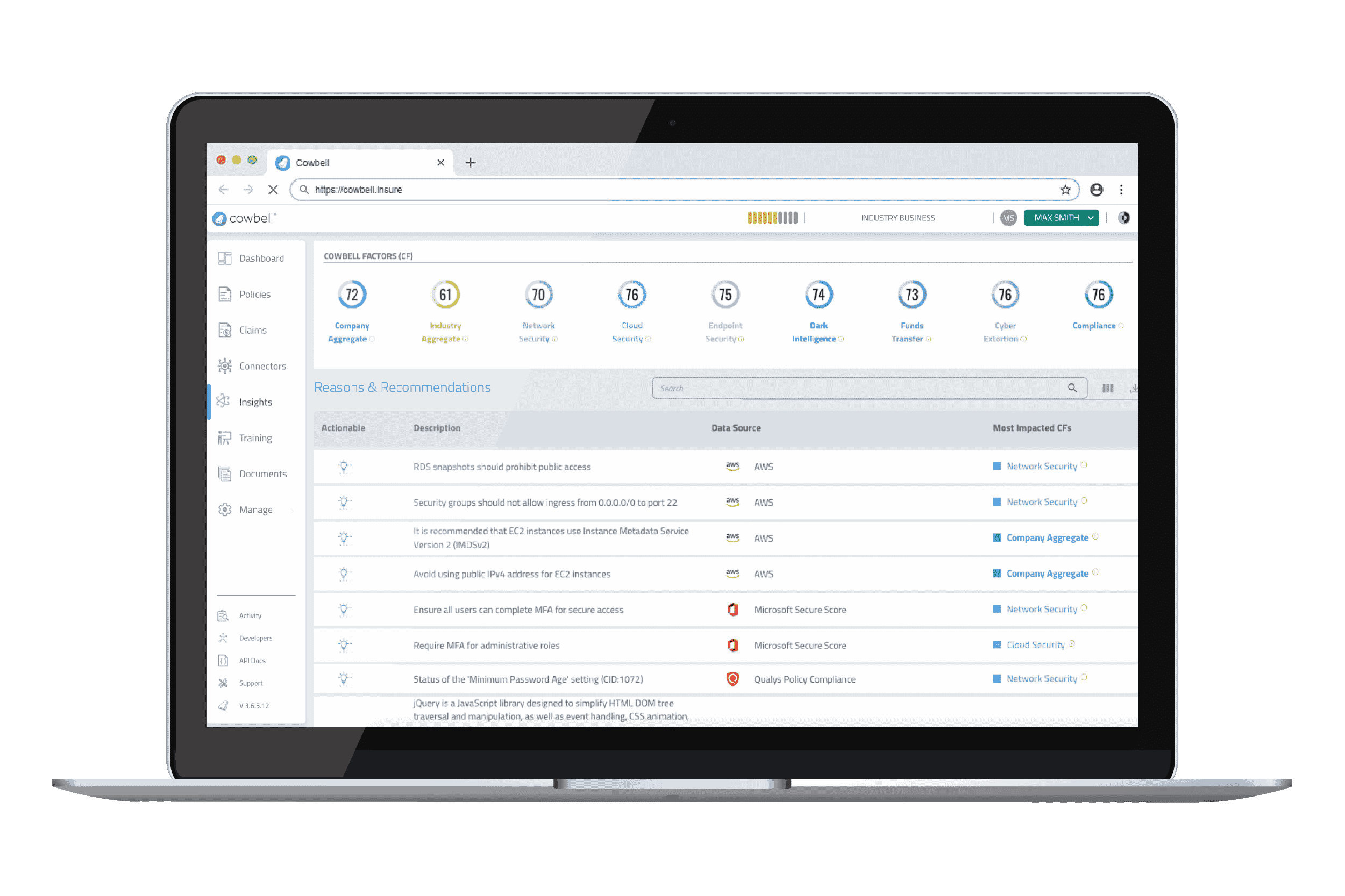

Cowbell’s AI/ML platform can assign scores from 1-100 in eight broad categories of customers’ cyber systems that could be targeted in an attack.

These include network security, cloud security, endpoint security, dark intelligence, funds transfer mechanisms and processes, cyber extortion prevention and readiness, compliance and supply chains.

These scores are known as Cowbell Factors, and together they form “a rating index that contributes to the evaluation of your organization’s cyber risk and, therefore, appropriate insurance coverage.”

Customers can view their Cowbell Factors’ scores and recommendations for how to improve them in a glanceable dashboard called Cowbell Insights.

Reducing ransomware payments down to just 26% of initial demanded amounts

As VentureBeat recently reported, ransomware attacks are fast on the rise, increasing 153% from a year ago, and “small and medium businesses (SMBs) in hard-hit industries including healthcare and manufacturing, are primary targets.”

The sheer volume of these types of cyber attacks — in which hackers seize control of a victim company’s computer systems and/or data using malware, and hold it hostage in exchange for ransom payments of untraceable cryptocurrency deposits — is such that experts even recommend SMBs accept them as inevitable.

Yet Cowbell believes that even if this is the case, the amount that enterprises pay to get their systems and data back from attackers should be lower.

As such, the company touts the fact that “Cowbell’s dedicated risk engineering and claims management service has prevented extortion payments over 74% of the time and when a ransom must be paid, it’s reduced to an average of 26% of the initial demand.”

How has Cowbell managed this feat?

“In every ransomware matter, we work closely with our carefully-vetted ransomware negotiation and forensic teams, and are active in the process,” Kudale wrote to VentureBeat. “Because of our expertise and active adjudication, we are able to identify efficiencies, strategies, and provide insight into obtaining the most efficient ransomware outcome.”

In other words: Cowbell’s cybersecurity experts closely follow the ransomware space and the groups and individuals responsible for successful attacks, and work to identify what amounts will make them go away without going overboard and dipping too far into the company’s cash reserves and claims reimbursements.

What Cowbell plans to do with the cash

The main goal for Cowbell now is to turn its new investment into profitability.

As Kudale wrote to VentureBeat: “Cowbell is on a path to operating profitability. We are executing our profitable growth strategy focusing on our chosen markets of the U.S. and continued expansion into the U.K., servicing upmarket customers and focusing on our channel productivity, improving our market differentiation, and servicing our brokers and customers.”

Indeed, in the U.K., Cowbell launched a new version of its cyber insurance called Prime One, which offers coverage for businesses “with annual turnover up to £250 million British pounds.” And, the company has its sights set on even higher coverage plans in the U.K. market at some point down the road.

According to Kudale, “Cowbell’s Prime One product is welcomed by U.K. [insurance] brokers, and we have seen rapid onboarding of customers in a short amount of time. All Cowbell value-added services are offered in the U.S. and are made available in the U.K. Building on this success, we look forward to going upmarket in the U.K. in the future.”

VentureBeat’s mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Discover our Briefings.