Solana (SOL), currently ranked as the fifth largest cryptocurrency with a market capitalization of $56 billion, has experienced a significant decline amid the recent market meltdown affecting the digital asset space.

Over the past 24 hours, SOL has witnessed an 8% drop, reflecting the broader market downturn. Despite this setback, experts believe that if the cryptocurrency maintains support above the $120 price level, it holds notable potential for a strong price recovery in the coming months.

Bullish Price Outlook And Key Support Levels To Watch

After reaching a yearly high of $209 on March 18, SOL’s current trading price is $124. However, according to crypto market experts, SOL still has a promising outlook.

Altcoin Sherpa, a renowned analyst, suggests that if the altcoin market continues to decline, the $120 price level may become an area of significant interest for SOL.

Altcoin Sherpa maintains a bullish sentiment, strongly believing that SOL can potentially exceed $500 this year. Such a surge would represent a significant 300% price increase from current levels, building upon the impressive 426% year-to-date price growth.

It is worth noting that this projection is nearly double SOL’s previous all-time high (ATH) of $259, reached during the last crypto market bull run in November 2021.

In addition to the analyst’s focus on the $120 price mark, other major resistance levels for SOL have been identified. These include $110, $102, and the critical long-term support level at $74, representing SOL’s uptrend structure over the past six months.

Solana Dominates Blockchain Trading Volume

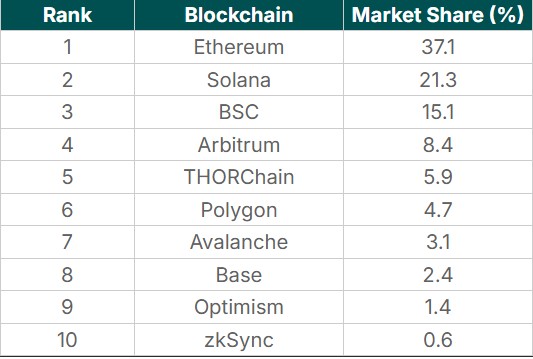

According to a recent CoinGecko report, Solana has secured its position as the second-largest blockchain by trading volume, commanding a substantial 21.3% market share in March 2024.

The blockchain platform experienced a notable monthly growth of 244.8%, with trading volume surging to $40.05 billion, a significant increase from $11.61 billion in February.

Solana’s performance in the first quarter of 2024 was equally significant. It accounted for 14.4% of all decentralized exchange (DEX) trading volume, totaling $62.31 billion.

This represents a quarter-on-quarter (QoQ) growth of 242.7% compared to the previous quarter’s volume of $18.18 billion. Despite strong growth, Solana’s market share in the same quarter ranked fourth, trailing behind Binance Smart Chain (BSC).

According to CoinGecko, Solana’s trading volume has been greatly bolstered by several factors. Firstly, the doubling in the price of Solana’s native token, SOL, has attracted increased attention and trading activity on the platform.

Additionally, the network has witnessed large airdrops from projects such as Jito (JTO) and Jupiter (JUP), further fueling trading volume. Moreover, the surge in memecoins on the Solana network has significantly contributed to its trading volume.

Notably, the launch of Book of Memes (BOME) in March proved successful, as it achieved a market capitalization of $1 billion within two days. BOME also secured listings on crypto exchanges like Binance and Bybit, further amplifying trading activity on Solana.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.